Last Updated on June 14, 2023 by

Financial independence is something that we all look for, from our initial days. Students also require significant money to run their educational journey smoothly.

Sometimes, a financial crunch hinders their education. In that case, an instant loan can be helpful. Many instant loan apps provide financial assistance to students so they can focus on their education without worrying about finances. It provides them with quick and easy access to funds. These apps can be used to cover unexpected expenses.

Many students opt to take out instant loans because they do not ask for collateral and have less waiting time. Here are the ten best instant loan apps for students in India to meet their financial needs.

Why should students choose an instant loan app?

There are many reasons why students should choose them.

Instant loan apps can give students the money they need to cover their tuition, books, and other costs.

Another reason is that it can help them build their credit. Using an instant loan app, students can demonstrate their ability to repay a loan. This can help them qualify for better interest rates on future loans.

What are the best instant loan apps for students in India?

These are some of the top instant loan applications for students in India:

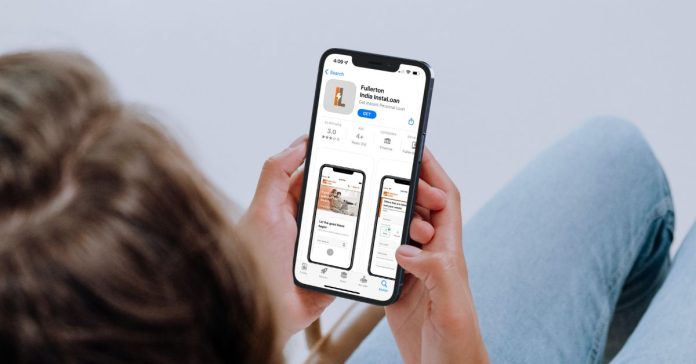

1. Fullerton India InstaLoan App

The InstaLoan app from Fullerton India is one of the best instant loan apps for a student.

With immediate approvals based on one’s eligibility for a personal loan, this instant loan app is a practical way for students to receive instant money. The app offers flexible terms between 12 and 60 months with interest rates beginning at 11.99% and a maximum loan amount of up to Rs. 25 lakhs.

2. mPokket

The mPokket quick loan for students covers both regular and extra academic fees. For various reasons, students may turn to mPokket for help when they want an instant, online personal loan. It is one of the best quick loan apps because of the low-interest rates, immediate cash availability, and lack of long-term EMI obligations.

Students can borrow around ₹ 500 to 30,000.

3. KreditBee

KreditBee is another useful app for quick student financing. Loans of up to ₹ 300,000 may be acquired through the app. If a person’s age is between 21 and 56, they may be able to apply for one of these loans.

Additionally, the process is 100% digital; only one must submit all supporting documents.

4. KrazyBee

Another well-liked option on the list and a terrific alternative for quick cash for college students is KrazyBee. Students may apply for quick credit loans for their semester fees, educational costs, shopping, and even a two-wheeler with just their student ID card and residence verification.

The loan to KrazyBee may be repaid in 12 months through convenient EMIs.

5. Pocketly

The next app on our list, Pocket, promises quick cash “anytime, anyplace!” Indian students may rely on the app for essential costs like tuition, leisure activities, etc.

They can get loan amounts ranging from ₹600 – ₹10,000.

6. RedCarpet

Students may get quick loans from RedCarpet for various online and offline operations. The app offers loans between ₹ 1,000 and ₹ 6,000 with a simple, interest-free 1-month return policy.

7. Slice Pay

To assist students who desire to borrow money, SlicePay provides free EMIs. SlicePay and MasterCard have partnered to make this possible. Undergraduate and graduate students may borrow up to ₹ 10,000 via SlicePay. They can obtain a loan for 30 to 90 days.

8. CashBean

This is one of the best apps for students looking for loans. The CashBean app lets one take out up to ₹ 60,000 in loans.

When applying for a loan, there is no demand for a credit history, and the procedure is entirely digital and paperless.

9. BadaBro

One of the top loan applications for students is BadaBro. The BadaBro college loan programme offers quick loans of up to ₹ 10,000 to higher-education students above 18. The loan has a 30-to-90-day repayment period.

10. PaySense

Online instant cash loans are available through the instant money app PaySense. Students can get loans up to 5 lakhs with this app with flexible repayment terms.

Conclusion

Before taking out an education loan, you should evaluate all the factors, including the amount of money required, the repayment terms, and the interest rate.

Students must also consider their future earnings potential and their repayment capacity.

Additional Read: IDO Development Service-Start your fundraising like a Pro